In this post I want to do a deepdive into regenerative food brand Omie.

They’re based in France and focus on staple foods.

Founder Joséphine Bournonville told her story on the Regen Brands podcast, and most of my notes, and research started there.

Here are 5 things that jumped out to me 👇

Regenerative =/= organic

Right now, 60-70% of Omie’s products are organic.

They aren’t presenting themselves as organic but as regenerative.

While regenerative organic is what they’re aiming for, they understand that most businesses aren’t there yet.

Instead of being dogmatic about only working with regen organic farmers they set the bar high (more on that later) and start improving from that point.

The way they communicate that to end customers is by showing the actual agricultural practices, and the programs that you’ve implemented.

Like these black lentils:

These are not organic, but Omie lists more details about how these are grown:

- It’s got the label “Zéro Résidu de Pesticide”

- Farmer, is going after “Haute Valeur Environnementale niveau 3”

Here are the programs they’ve implemented:

- Overall: volume agreement, price based on production costs & roadmap to transition

- This year: training the farmer on cover crops, assitance to help with reducing tillage and cover crop

- Next year: further training on agricultural diagnostics

Regenerative index score

One essential piece in their approach to regenerative agriculture is the Regenerative index score (in french: indice de régénération).

This score was developed by non-profit agroecologie.org and it looks at a number of different practices to see how a farmer scores.

For all its farmers, Omie finances this audit, and they require a minimum score of at least 40/100, and important is the commitment to do more and improve.

Next, Omie has a team of 4 agro engineers on the payroll to create a roadmap of what the next 3 years look like in terms of transition as well as help farmers implement this.

They use 1% of sales to finance this approach, I love it!

Breakdown of pricing

For every product, Omie has a clear breakdown of how the price is made up.

Like for this lentil curry that costs $5.97:

On their website they have a full breakdown, and at the poin of sale, they show the money the farmer gets, and how much is spent on logistics.

This approach reminded me of another French brand called C’est qui le patron that does a similar breakdown for its products:

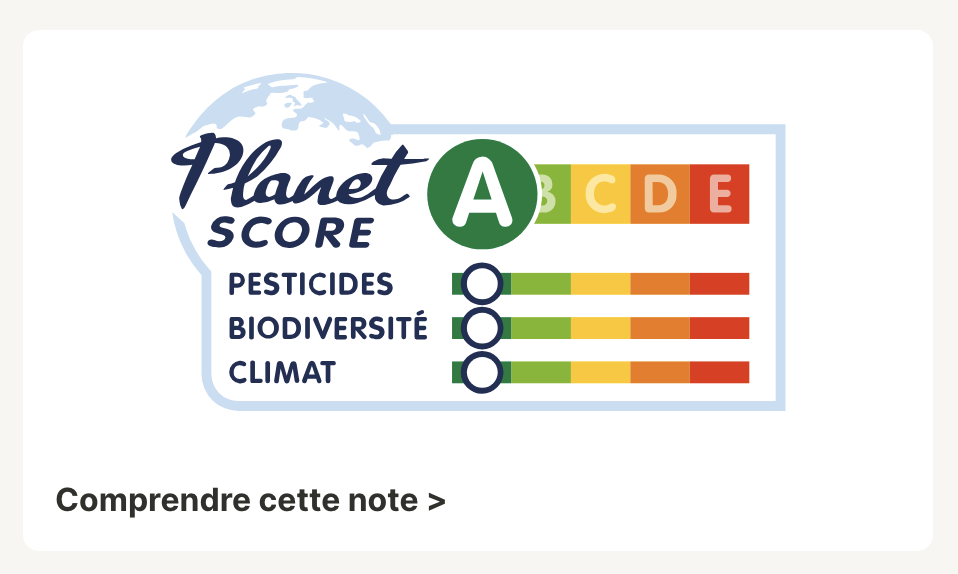

Planet score

While the regenerative index score is the backbone of the whole operation, it’s main use is to vet and evaluate suppliers.

To communicate the benefits of regenrative agriculture with their customers, they use something called Planet score:

This tool is developed by ITAB measure products based on the whole product lifecycle:

- Farming

- Processing

- Transport & logistics

- Packaging

- Consuming

- End of life

It’s a pretty in-depth but transparent analysis.

And to illustrate that they don’t have everything figured out yet, here is the score for their cookies:

The reason for the low score is that the main ingredient of their cookies, butter, has a very poor tracebility.

That has to do with the way butter is produced from its raw ingredient milk with a complex supply chain.

But it also gives them a clear path forward, they know what to tackle!

How did Omie start?

When they first got started, they sold baskets of non-existing products to friends and family whol believed in the idea.

This was during the pandemic when they expanded to be super local, use bikes to deliver everything, and have a strong local community.

Early on, this direct link with consumers was huge, they relied 100% on ecommerce.

Later, the started working together with basket companies to include Omie products in their baskets.

In 2023, they started getting inbound requests from retailers, leading them to get into Decathlon.

Now they’re further venturing into retail.

Mainly by using specialized distributors in natural and organic foods. These distributors have seen the revenues from organic decrease, this opens them up for new opportunties.

Product range

One of the fascinating things is that they’ve expanded their catalog super quickly.

After 1 year they already had 80 products, and today they’ve got 250!

One way they’ve sped up this process was to work with existing manufacuers and use their recipes and supplier.

Then for each products they made tweaks to the recipe orn suppliers to make sure they’re at least en route towards regeneration.

They work with 40 manufacurers with 200 farmers.

As they’re expanding into retail, they’re doubling down on their strenghts:

- Ready made meals

- Sauces

- Salty snacks

- Sugary snacks

Leave a Reply